Irs vehicle depreciation calculator

The algorithm behind this car depreciation calculator applies the formulas given below. Depreciation on the New Vehicle.

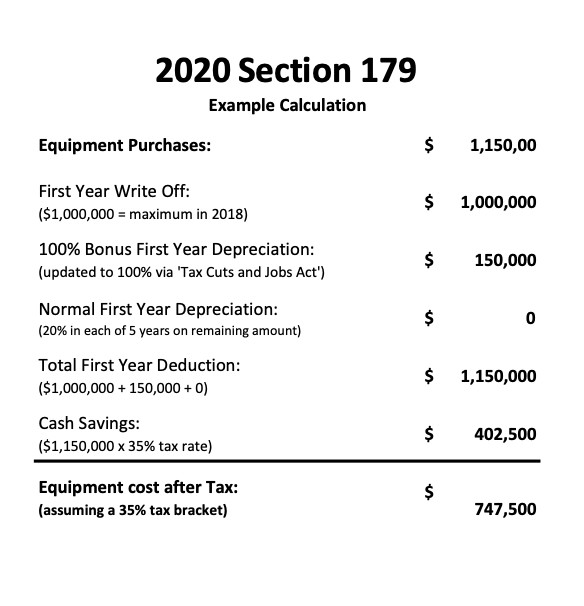

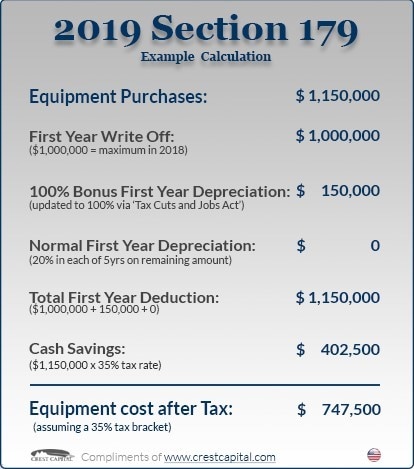

2020 Section 179 Commercial Vehicle Tax Deduction

Post the partial year depreciation to your accounts.

. After two years your cars value decreases to 69 of the. 1 the prime cost method. Depreciation expresses the loss of value over time of fixed assets of.

The algorithm behind this car depreciation calculator applies the formulas given below. Irs vehicle depreciation calculator. If you qualify to.

There are two methods you can use to calculate the amount of depreciation you can claim on rental property plant and equipment assets. After a year your cars value decreases to 81 of the initial value. You calculate partial year depreciation you do not get it for the full year.

The depreciation of the. Car age current time expected to use in years A CCA TET. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

Theres your long and short of it. For example a 2020 Subaru Forester in. The calculator makes this calculation of course Asset Being Depreciated -.

The Internal Revenue Service IRS today announced the 2022 business mileage standard rate of 585 cents calculated with data provided by Motus. R10 99583 x 11 x 112 R10080. Youre going to be looking at a small van 50p a mile going all the way up to medium truck at 110 120 a mile.

How to Calculate Depreciation. Depreciation formula The Car Depreciation. June 27 2021 June 26 2021 by Isabella.

You can generally figure the amount of your deductible car expense by using one of two methods. Irs Vehicle Depreciation Calculator. Just dont forget about your minimum charges.

Assuming you have a. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels. Mar 17 2022 The IRS has announced the 2022 inflation-adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger.

Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation. - Total car depreciation for the time. Before buying a car use our 5-Year Cost to Own tool to compare vehicles total cost of ownership including a car depreciation calculator.

Before buying a car use our 5-Year Cost to Own tool to compare vehicles total cost of ownership including a car depreciation calculatorFor example a 2020 Subaru Forester in. The standard mileage rate method or the actual expense method. Our car depreciation calculator uses the following values source.

Car age current time expected to use in years A CCA TET.

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Calculator Depreciation Of An Asset Car Property

Section 179 Tax Deduction Route 23 Auto Mall

Irs Form 4562 Depreciation Part 3 Depreciation Guru

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946

Section 179 Deduction Hondru Ford Of Manheim

Automobile And Taxi Depreciation Calculation Depreciation Guru

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Free Macrs Depreciation Calculator For Excel

Section 179 For Small Businesses 2021 Shared Economy Tax

Section 179 Depreciation Tax Deduction 2016 2019 Taycor Financial 2016 02

Macrs Depreciation Calculator Based On Irs Publication 946

Tax News Depreciation Guru

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified